[av_image src=’https://home.ncourt.com/wp-content/uploads/2020/01/modular-court-tech.jpg’ attachment=’3893′ attachment_size=’full’ align=’center’ styling=” hover=” link=” target=” caption=” font_size=” appearance=” overlay_opacity=’0.4′ overlay_color=’#000000′ overlay_text_color=’#ffffff’ copyright=” animation=’no-animation’ av_uid=’av-5uib5t’ admin_preview_bg=”][/av_image]

[av_textblock size=” font_color=” color=” av-medium-font-size=” av-small-font-size=” av-mini-font-size=” av_uid=’av-4hdu1d’ admin_preview_bg=”]

There is an alarming trend among court managers — the tendency to acquire technology without fully understanding how it works, or if it will translate to success in their specific court. They may also fail to recognize that their newly adopted suite of court management services will likely no longer meet their needs in a few short years. With new technology hitting shelves every day, court managers may feel overwhelmed when deciding on a solution to meet their business requirements. Fortunately, courts can take a modular approach to technology adoption, called court component modeling, that will equip them to adapt to new challenges.

What is court component modeling?

One way to define court component modeling (CCM) is to compare it to the traditional approach to court technology. Most case management systems (CMSs) are applied as monolithic, one-size-fits-all suites; while comprehensive in some cases, this approach is known to be ineffective in a rapidly evolving market. In contrast, the component model is highly modular and allows courts to mix and match programs for their individual needs, even if the programs come from multiple vendors. With CCM, courts can adopt technology based on their business strategy — rather than the other way around — and meet emerging business requirements by adjusting or supplementing their components instead of replacing an entire suite.

Components are also designed to be platform-agnostic in their interactions with other programs, independently deployable, and highly scalable. When combined with guidance from a trusted technology provider such as nCourt, these components will be easier to adopt and use than full, restrictive suites.

How is a court component model implemented?

In order to begin the adoption process, court managers should assess their business needs by asking themselves and their team a range of questions, including:

- What tools will allow us to meet our current needs without restricting us in the future?

- What are the gaps in our technological environment, and what technologies exist to help us fill those gaps?

- What are the needs of our citizens, and how will the tools we select improve their access to procedural justice?

It may also help for court leaders to view their computing environment as an array of technological building blocks, rather than a consolidated CMS. From there, they can decide which components to use.

Components often are categorized as either case management or supplemental components. Case management components may include the central case manager many courts are accustomed to, as well as a financial manager and a document manager. Supplemental components may include e-filing tools, evidence management, and ePayment services. There are many more, depending on the provider, but the beauty of the component model is that it allows courts to exclusively pick and choose the tools they need to manage cases.

What are the benefits of court component modeling?

By creating a modular technological environment that can evolve with the market, CCM positions court professionals to be ready for the future. It also enables them to fill the gaps in service that may have existed under the traditional approach to technology. Courts that adopt CCM-based systems will be free to create a best-in-class solution composed of components from diverse vendors.

Inflexible courtroom technology can create challenges for clerks and professionals alike. With the help of the court component model, however, court leaders can make real change in this area. When court leaders do the proper research and choose the components that will have the greatest impact in their court environment, they will be better equipped to face coming changes in the industry.

[/av_textblock]

[av_social_share title=’Share this entry’ style=’minimal’ buttons=” custom_class=” av_uid=’av-7vuup’]

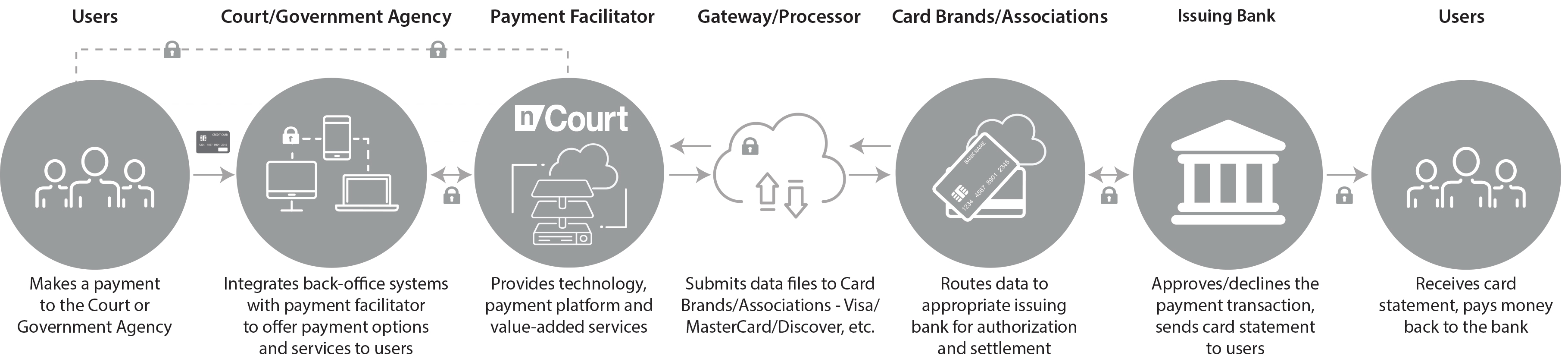

Smartphones have allowed for an extensive ecosystem of digital payments. Enabling payment options such as Apple Pay, Google Pay, and Samsung Pay allow smartphone users to experience mobile wallets easily. In a world where individuals are becoming not only accustomed to but also expectant of instant gratification, payment processing is becoming increasingly simplified. These instant payment options are widespread in both formal and informal payment scenarios, ranging from shopping, utilities, citations, bail, tuition, taxes, and more.

Smartphones have allowed for an extensive ecosystem of digital payments. Enabling payment options such as Apple Pay, Google Pay, and Samsung Pay allow smartphone users to experience mobile wallets easily. In a world where individuals are becoming not only accustomed to but also expectant of instant gratification, payment processing is becoming increasingly simplified. These instant payment options are widespread in both formal and informal payment scenarios, ranging from shopping, utilities, citations, bail, tuition, taxes, and more.