[av_image src=’http://home.ncourt.com/wp-content/uploads/2018/03/payment-processing-1200×430.jpg’ attachment=’3611′ attachment_size=’featured’ align=’center’ styling=” hover=” link=” target=” caption=” font_size=” appearance=” overlay_opacity=’0.4′ overlay_color=’#000000′ overlay_text_color=’#ffffff’ animation=’no-animation’ custom_class=”][/av_image]

[av_image src=’http://home.ncourt.com/wp-content/uploads/2018/03/blog-payment-processing-1.jpg’ attachment=’3527′ attachment_size=’full’ align=’center’ styling=” hover=” link=” target=” caption=” font_size=” appearance=” overlay_opacity=’0.4′ overlay_color=’#000000′ overlay_text_color=’#ffffff’ animation=’no-animation’ custom_class=”][/av_image]

[av_textblock size=” font_color=” color=” custom_class=”]

Not so many years ago, payment options simply included cash, checks, and credit cards. Today, the options seem limitless as individuals are making online payments around-the-clock and employing technologies such as mobile point-of-sale (mPOS) and mobile wallet, among others. The evolution and adoption of financial technology (fintech) and payment processing continues at a rapid pace. As one Entrepreneur article states, “The reality is, new breakthrough technologies and digitization initiatives are reinventing the ‘art of the possible’ in payments and ushering in a new world of multiple wallets, ‘devices,’ and supporting infrastructure. More specifically, they are simplifying the payment process and rendering it invisible.”

As payment options continue to evolve, many people today simply swipe, tap, or flash their mobile wallets without a thought to the complex ecosystem involved in the transfer of funds. What really happens to these processed payments and what does this mean for the future of court and government payments?

Smartphones have allowed for an extensive ecosystem of digital payments. Enabling payment options such as Apple Pay, Google Pay, and Samsung Pay allow smartphone users to experience mobile wallets easily. In a world where individuals are becoming not only accustomed to but also expectant of instant gratification, payment processing is becoming increasingly simplified. These instant payment options are widespread in both formal and informal payment scenarios, ranging from shopping, utilities, citations, bail, tuition, taxes, and more.

Smartphones have allowed for an extensive ecosystem of digital payments. Enabling payment options such as Apple Pay, Google Pay, and Samsung Pay allow smartphone users to experience mobile wallets easily. In a world where individuals are becoming not only accustomed to but also expectant of instant gratification, payment processing is becoming increasingly simplified. These instant payment options are widespread in both formal and informal payment scenarios, ranging from shopping, utilities, citations, bail, tuition, taxes, and more.

Thousands of companies are developing transaction options and updates for users to stay ahead of trends. Because so many companies are competing and collaborating to facilitate transactions both within and outside the fintech market, product competency and customer support are imperative for success. And with so many options, user education is critical. Finding and working with the right company can help ensure streamlined payment transactions.

The payment processing landscape

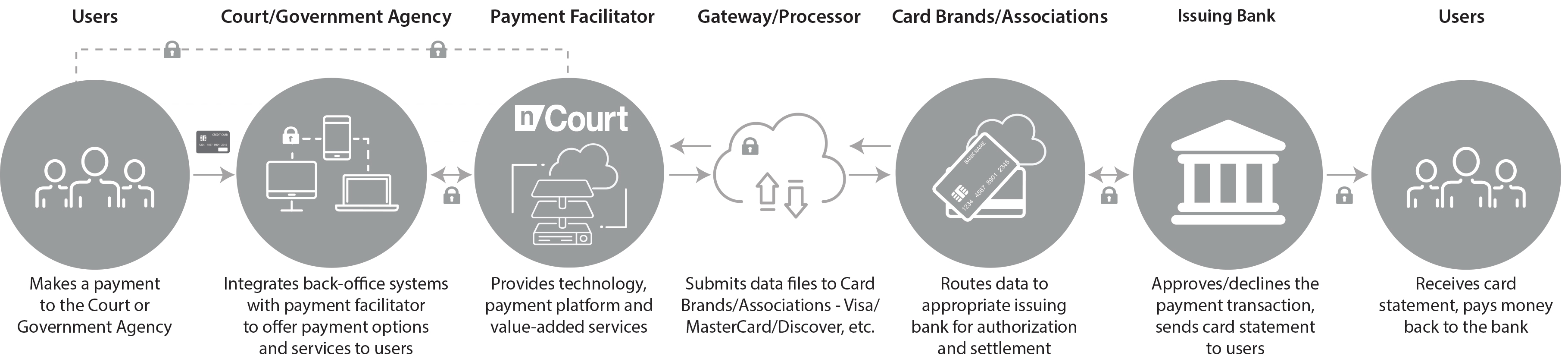

From the user(s) perspective, processing payments seems quite simple — you either make a purchase or accept electronic payments — but behind the scenes is a makeup of sophisticated and complex interdependencies and players — all interfacing, communicating, and exchanging data within their respective technology to facilitate the complete cycle of the payment transaction.

Below is a simplified overview of nCourt’s processing activities within the payment ecosystem:

- User — Makes a payment utilizing processing solutions offered by the court or government agency

- Court or government agency — Receives the user’s payment via the payment facilitator’s processing solutions

- Payment facilitator — Provides technology, payment platform, and value-added services – securely captures electronic transaction data for court or government agency and transfers appropriate data

- Gateway or processor — Receives data transfer file from payment facilitator for submission to card association such as Visa, MasterCard, AMEX, and Discover

- Card association — Routes the transaction data to the respective issuing bank for settlement

- Issuing bank — Approves or declines transaction data and submits response back to payment facilitator, sends credit card statement to user

- User — Is billed amount via the ticket or citation statement issued by the court or government agency, pays back the issuing bank

Keeping up with a changing payment landscape

The speed of change in the payment ecosystem makes it difficult to stay up-to-date, which is why many courts and government agencies rely on third-party payment providers to help pave the way for innovative payment solutions. An experienced and knowledgeable partner not only helps to reduce costs and ensure seamless funds transfers but also stays abreast of next-generation payment options so courts and government agencies can focus on what they do best — serving the public.

With payment methodologies being driven more by end-users than ever before, it’s becoming equally important for the public sector to make payments as conveniently and seamlessly as possible. Consumers will continue to be the pivoting factor changing the payment landscape, so it’s important to partner with a provider who understands payments and the technology relevant to your market and organization.

[cta]With nCourt, payment processing becomes seamless, enabling you to provide online, mobile, counter, phone, and retail store payment options to make payments effortless and convenient. Learn more.[/cta]

[/av_textblock]

[av_social_share title=’Share this entry’ style=’minimal’ buttons=” custom_class=”]